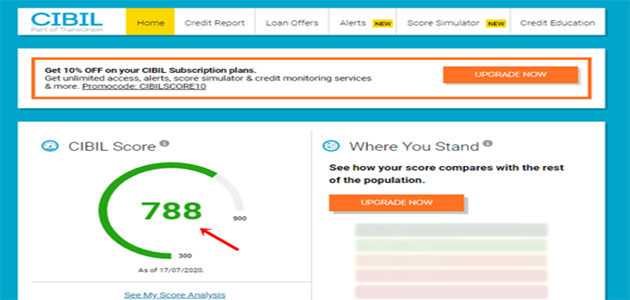

A CIBIL FICO rating is one of the main parts of your whole monetary wellbeing. What’s more, consequently, every moneylender and monetary foundation surveys your Cibil Score is Not Updated report at whatever point you apply for an advance or Mastercard.

Your reimbursement history is all used to construct your FICO rating. However, CIBIL refreshes your financial assessment occasionally and so that you could see the adjustment of the report, you might need to sit tight for quite a while.

CIBIL financial assessment is the significant indicator of how well you are dealing with your individual accounting records. It helps the loan specialists and banks to comprehend the manner in which you have been Often is Genshin Impact Updated. Not just that, it additionally assists them with having a thought whether you will actually want to reimburse the sum that you are requesting to acquire from them.

In the event that you’re hoping to purchase another home or take out an auto advance, you might be checking your FICO assessment consistently paving the way to your application to see where it stands. Be that as it may, on the grounds that you check it frequently doesn’t mean there will be an update.

FICO ratings revive at various times consistently and there might be times where it requires a couple of days or weeks before your Cibil Score is Not Updated. Furthermore, regardless of whether you really take a look at it today and go to apply for an advance or charge card tomorrow, your score might change.

At the point when you apply for a new line of credit or some other sort of credit, it gets answered to CIBIL and other FICO score organizations in the country. CIBIL then, at that point, continues to refresh your report according to your reimbursement conduct. That implies, in the event that you postpone your reimbursement or miss a solitary cutoff time, it is pondered your CIBIL credit report and a couple of focuses get knocked off from your FICO rating.

Why is it Important to have a Good CIBIL Credit Score?

Your credit score is a measurement of your creditworthiness and general financial health. Building a good CIBIL credit score is essential because it’s a fundamental component of your financial identity. A strong Cibil Score is Not Updated might give you an advantage when applying for loans, while a bad credit score can increase the cost of your financial transactions including a credit card.

Having a good CIBIL credit score will help you in getting loans at the best interest rates while a bad score may land you up with offers with high interest rates. You may also not get the credit limit you had requested for while applying for a credit card with a poor credit score.

How often does your CIBIL Credit Score Update?

Whenever you take out a loan or any other type of credit, it gets reported to CIBIL and other credit rating agencies in the country. CIBIL then keeps updating your report as per your repayment behavior. That means, if you delay your repayment or miss a single deadline, it is reflected on your CIBIL credit report and a few points get knocked off from your Cibil Score is Not Updated.

By and large, there could be two circumstances for the CIBIL score updation:

- When a reimbursement is made

- When a dispute is raised

1. CIBIL Credit Score Updation when a Repayment is Made

However, the CIBIL FICO rating doesn’t get updated the second you make a reimbursement. Ordinarily, credit departments update the report once in a month. You should pause and track your CIBIL report to actually look at something very similar. CIBIL FICO ratings aren’t updated promptly.

At the point when you make an installment against your Visa or obligation, the moneylender sends this data to the credit office. Your Cibil Score is Not Updated rating may likewise take a piece longer to refresh. It depends on your other monetary exercises with respect to when the score will refresh.

2. CIBIL Credit Score Updation when a Dispute is Raised (H3 Tag)

On the off chance that you have raised a dispute with CIBIL because of certain blunders on your report, then you might need to sit tight for 90 days (90 days) for the dispute goal, post which, your CIBIL FICO rating will refresh.

What to do in the event that the CIBIL FICO assessment isn’t Getting Updated?

There might be a strange circumstance when your Cibil Score is Not Updated assessment is not getting updated. FICO assessment being the significant indicator of your monetary wellbeing, you really want to get it updated consistently. In the event that, your CIBIL FICO rating is not by any stretch getting updated, you might follow the under two (2) steps:

- You should initially reach out to your loan specialists or banks to check whether they have given CIBIL the latest data on your reimbursement. Your latest CIBIL financial assessment should mirror this assuming there is no deferral at their end.

- Remember to circle back to them to check whether they have announced the information change subsequent to giving verification of dispute goal in support of yourself, which you would have gotten.

You ought to routinely survey your CIBIL acknowledge report as it assists you with remaining focused to construct a decent score. Survey your credit report to check for mistakes and raise a dispute in the event that you track down anything dubious in it and get it revised straightaway.